Purchase Vs Rent: Comprehending the Advantages And Disadvantages of Staying In an Apartment

The choice to buy or lease an apartment involves careful factor to consider of different factors. Each alternative presents distinctive advantages and negative aspects that can significantly impact one's monetary scenario and way of life. Customers typically face huge upfront prices and ongoing upkeep duties, while renters enjoy versatility and reduced preliminary financial investments. As people evaluate these aspects, understanding the subtleties of each choice becomes essential. What variables eventually affect the choice in between these 2 paths?

The Financial Aspects of Buying an Apartment

When taking into consideration the purchase of an apartment, possible customers need to carefully examine the monetary ramifications involved. The preliminary costs can be significant, including the down payment, closing costs, and various costs related to assessments and appraisals. Customers should likewise consider recurring expenditures such as home taxes, house owners' organization (HOA) fees, insurance, and maintenance costs.Financing choices play a crucial role in the general cost of the house. apartments for rent glen carbon il. Rate of interest rates, finance terms, and credit report can greatly affect month-to-month home mortgage repayments. Additionally, potential buyers need to think about the long-lasting financial investment worth of the residential property, as property can value with time, offering monetary benefits in the future.Ultimately, detailed research study and economic preparation are essential for making a notified choice regarding purchasing an apartment. Customers need to consider the possible returns versus their monetary security and personal scenarios to guarantee an audio investment

The Financial Implications of Renting Out

The monetary effects of leasing consist of regular monthly rental prices, which can vary based upon location and market conditions. Occupants also birth much less obligation for upkeep expenses, as these generally drop on the landlord. Nonetheless, the lack of lasting financial dedication can impact one's capacity to construct equity in time.

Month-to-month Rent Expenses

Although lots of individuals are drawn to the versatility that renting out deals, the monetary ramifications of month-to-month rent prices can greatly impact their budget plans. Rent typically stands for a significant part of a renter's monthly costs, often varying from 25% to 50% of their income. This irregularity depends upon variables such as place, residential property dimension, and facilities. Furthermore, rent out repayments are required regularly, making it essential for tenants to preserve a stable revenue to avoid economic pressure. Unlike home mortgage repayments, which construct equity in time, rental fee settlements do not add to property buildup. Therefore, prospective tenants must thoroughly assess their monetary scenarios and think about exactly how regular monthly rental fee expenses will certainly fit right into their total spending plan prior to dedicating to a rental arrangement.

Maintenance Expenditures Responsibility

While renters delight in the advantage of not having to fret about lots of upkeep jobs, they may still face considerable monetary implications regarding obligation for upkeep. Normally, property owners are responsible for significant repairs and maintenance, which alleviates some expenses for occupants. Tenants might be liable for small repair work, such as replacing light bulbs or repairing a dripping faucet. Additionally, unexpected expenditures can occur from concerns like pipes or electrical failings, which might result in raised monetary problem if not covered by the lease contract. Tenants must also take into consideration the potential for rent boosts to cover upkeep costs. Consequently, while upkeep responsibilities are mainly changed to property managers, occupants must stay knowledgeable about their responsibilities and feasible prices that can arise during their lease term.

Lasting Economic Dedication

Financial stability frequently rests on the choice between renting out and getting an apartment, specifically when taking into consideration the long-lasting dedications connected with each alternative. Renting out may show up financially flexible, enabling individuals to relocate easily and prevent hefty deposits. It can lead to recurring monthly costs without building equity. Tenants undergo annual rent boosts, which can stress budgets in time - luxury apartments for rent edwardsville il. In addition, the absence of possession indicates that rental settlements do not add to lasting wide range buildup. On the other hand, purchasing an apartment normally involves a considerable in advance financial investment yet offers the capacity for property value admiration. Inevitably, the selection in between renting and getting needs cautious examination of one's financial objectives and lasting security

Stability vs. Versatility: Which Is Right for You?

When thinking about home living, people commonly evaluate the benefits of stability against the requirement for versatility. Long-term dedications, such as purchasing a residential property, can give security however might restrict wheelchair and versatility. Alternatively, renting permits for higher flexibility to relocate, dealing with those whose situations might transform often.

Lasting Dedication

Selecting between acquiring and leasing an apartment frequently hinges on the individual's need for security versus their need for adaptability. A lasting commitment to acquiring normally shows an objective to resolve in one place, cultivating a sense of permanence. Homeownership usually includes monetary advantages, such as equity building and possible admiration in building value, adding to lasting safety and security. Alternatively, renting permits for better adaptability, allowing people to alter their living scenario based upon life circumstances or choices. Renters may favor this option during changing periods, such as task modifications or individual development. Inevitably, the choice between a lasting dedication to possession or the adaptability of renting out reflects individual top priorities and future aspirations, significantly affecting one's lifestyle and financial planning.

Flexibility and Versatility

The decision to get or rent out an apartment substantially influences a person's mobility and flexibility in life. Homeownership normally uses security but can restrict versatility due to the long-lasting financial dedication and effort needed to market a residential or commercial property. Alternatively, renting out enables greater wheelchair, enabling people to transfer quickly for work chances or lifestyle modifications without the burden of offering a home. This adaptability can be particularly helpful for those in shifting stages of life, such as pupils or young professionals. While leasing can lead to a lack of durability, it gives the freedom to discover different areas and cities. Eventually, the option in between buying and leasing depend upon personal concerns-- security versus the requirement for flexibility in an ever-changing world.

Maintenance Duties: Homeownership vs. Renting

While homeownership usually brings the appeal of self-reliance, it also includes a substantial problem of upkeep obligations that tenants generally stay clear of. Homeowners need to manage repair services, landscaping, and routine maintenance, which can be both lengthy and expensive. This includes addressing plumbing problems, roofing system repairs, and home appliance breakdowns, every one of which can add stress and anxiety to the homeowner's life.In comparison, occupants normally take advantage of a more hands-off technique to maintenance. Residential property supervisors or proprietors take care of fixings and maintenance jobs, permitting renters to concentrate on their living experience instead of home treatment. This division of responsibilities can be specifically appealing for those who focus on adaptability and simpleness in their living arrangements.Ultimately, the option in between purchasing and renting joints on one's willingness to tackle maintenance responsibilities, with homeownership requiring a commitment that many occupants may favor to sidestep.

Financial Investment Prospective: Getting an Apartment

Buying an apartment can use significant financial advantages gradually. As home worths normally appreciate, house owners may see their financial investment grow significantly, generating a lucrative return when marketing. Furthermore, owning an apartment supplies a bush against rising cost of living, as mortgage settlements continue to be steady while rental rates may raise. The possibility for rental earnings includes one more layer of economic advantage; owners can rent their devices, producing easy earnings home that can counter home mortgage expenses and contribute to general wide range accumulation.Furthermore, tax benefits commonly come with apartment possession, consisting of deductions for mortgage passion and residential or commercial property taxes. These monetary incentives improve the good looks of purchasing an apartment as an investment. Prospective capitalists should likewise take into consideration market variations and connected possession costs, such as maintenance and association charges. A comprehensive evaluation of these aspects can aid determine if acquiring an apartment lines up with a person's economic objectives and run the risk of the real realtors tolerance.

Way Of Living Considerations: Features and Area

Picking the right apartment or condo entails careful consideration of way of life elements, particularly services and area. Several people focus on amenities that boost their living experience, such as gym, swimming pools, or communal rooms. These centers can especially influence everyday routines and social communications, making apartment or condo life much more enjoyable.Location is similarly vital; closeness to function, colleges, purchasing, and mass transit influences ease and general quality of life. Urban occupants may favor apartments in dynamic neighborhoods, while those looking for tranquility could choose suburban settings. In addition, safety and area vibe play crucial functions in identifying an ideal location.Ultimately, the ideal combination of facilities and area can create an unified living setting that aligns with personal choices and way of living needs. Each person's priorities will differ, making it important to review these aspects very carefully prior to choosing about getting or renting an apartment.

Lasting vs. Temporary Living Arrangements

The decision in between long-lasting and short-term living arrangements substantially affects one's house experience. Long-lasting leasings generally offer security, allowing renters to develop origins in an area. This security often leads to a deeper understanding of local facilities, social connections, and individual convenience. Furthermore, long-lasting leases may offer lower regular monthly rates contrasted to temporary options, which are frequently much more expensive due to flexibility.Conversely, short-term setups interest those looking for flexibility or short-term real estate options. This flexibility can be helpful for individuals checking out new cities, traveling for job, or examining. Temporary rentals usually do not have the feeling of durability and may entail constant relocations.Ultimately, the selection between long-term and temporary living depends on private conditions, concerns, and way of life choices. Mindful consideration of these variables can cause a more enjoyable house experience, customized to one's details needs.

Often Asked Concerns

Just How Do Building Taxes Influence Apartment Ownership Prices?

Property taxes substantially influence the general prices of home ownership. Higher taxes can raise regular monthly expenditures, affecting budgeting. Additionally, fluctuating tax obligation rates may impact residential property values, making ownership much less financially helpful in specific markets.

What Are Regular Lease Lengths for Rental Apartment Or Condos?

Typical lease lengths for rental houses normally vary from six months to one year. Some proprietors may offer month-to-month alternatives, while longer leases of two years or even more can additionally be worked out depending upon occupant requirements.

Can I Discuss My Rent Rate With Landlords?

Working out lease costs with property owners is frequently possible, depending upon market conditions and the property owner's flexibility. Prospective tenants should prepare to present their situation, highlighting factors for arrangement to boost their possibilities of success.

What Happens if I Required to Break a Rental Lease?

When a renter needs to damage a rental lease, they might incur penalties, forfeit their down payment, or face legal repercussions. It's important to evaluate the lease terms and communicate with the property owner promptly.

Exist Hidden Costs When Acquiring an Apartment?

When acquiring an apartment, prospective hidden costs might include shutting costs, upkeep fees, residential property tax obligations, and home owners association charges. Purchasers must completely examine all economic facets to avoid unforeseen Click This Link costs post-purchase.

Jonathan Taylor Thomas Then & Now!

Jonathan Taylor Thomas Then & Now! Dylan and Cole Sprouse Then & Now!

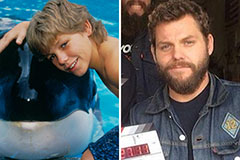

Dylan and Cole Sprouse Then & Now! Jason J. Richter Then & Now!

Jason J. Richter Then & Now! Hailie Jade Scott Mathers Then & Now!

Hailie Jade Scott Mathers Then & Now! Heather Locklear Then & Now!

Heather Locklear Then & Now!